PRACTICES

Banking and FinanceCorporate and Securities

Financial Services

Exempt Organizations

Specialty Industries

Consumer Financial Services Litigation and Compliance

Emerging Technologies

EDUCATION

New York University, B.S., 1991Brooklyn Law School, J.D., 1995

ADMISSIONS

- 1996, New York

-

Corporate Transparency Act — Year-End Updates and Compliance Deadlines09/24/2024

In this client alert, Warshaw Burstein Managing Partner Fred Cummings and Partner/ Chair of the Tax Law Group Jason Diener provide year-end updates on the Corporate Transparency Act, whose rules requiring disclosure of entity beneficial ownership are set to take effect in January.

-

Warshaw Burstein Advises Nexalin Technology on $5.25 Million Secondary Offering07/25/2024

Corporate partners Martin Siegel and Steve Semian, along with tax partner Jason Diener, represented Nexalin Technology, Inc., as securities and general corporate counsel with respect to Nexalin’s public offering of 2,315,000 shares of common stock, which closed on July 1, 2024.

-

Warshaw Burstein Adds Family Law, Tax (Private Client) Practice Areas to IR Global Membership07/25/2024

Warshaw Burstein, LLP today announced it has added several additional attorneys and the Family Law and Tax (Private Client) practice areas to its membership in IR Global, a multi-disciplinary professional services network that provides legal, accountancy, and financial advice to companies and individuals internationally.

-

AAML New York Hosts Annual May Weekend At Harvard Club05/22/2024

Eric I. Wrubel Serves as President of the AAML-NY, Steve Semian Participated in CLE Panel

-

New Rules Requiring Entity Beneficial Ownership Disclosure Set to Take Effect January 1, 202411/28/2023

U.S. Treasury Department's Financial Crimes Enforcement Center unit rules governing the disclosure of beneficial ownership information are currently set to become effective January 1, 2024. The new rules contain ambiguities regarding certain fundamental definitions, and do not definitively resolve issues regarding access to the beneficial owner information reported as well as mechanical aspects of the reporting procedures.

-

How the SEC Selects Investment Advisers for Examination10/16/2023

In a recent Risk Alert, the Division of Examinations of the SEC provided guidelines explaining how it utilizes a risk-based approach for selecting SEC-registered investment advisers to examine and for determining the risk areas to examine. If you have any questions concerning how to prepare or organize for an SEC examination, please contact Meryl Wiener or your regular Warshaw Burstein attorney.

-

Care Obligations of Broker-Dealers and Investment Advisers08/23/2023

Earlier this year, the SEC staff issued a bulletin setting forth standards of conduct for broker-dealers and investment advisers with respect to their respective care obligations when providing investment advice and recommendations to retail investors (the “Bulletin”).

-

Warshaw Burstein Joins IR Global07/31/2023

Warshaw Burstein, LLP today announced it has joined IR Global, a multi-disciplinary professional services network that provides legal, accountancy, and financial advice to companies and individuals around the world.

-

Warshaw Burstein Represents Nexalin in International Joint Venture06/07/2023

Corporate partners Martin Siegel, Steve Semian, and Jason Diener represented Nexalin Technology, Inc. in the creation of a formalized joint venture arrangement with Wider Come Limited.

-

SEC Announces 2023 Examination Priorities03/29/2023

On February 7, 2023, the SEC’s Division of Examinations announced its examination priorities for 2023. Examination priorities are released annually and provide investors and registrants with transparency into those areas that DOE believes bring heightened risks to investors, registrants and to the integrity of the U.S. capital markets.

-

Warshaw Burstein Promotes Corporate Attorney Steve Semian to Equity Partner03/06/2023

Litigator Maxwell Rubin Promoted to Counsel

-

Warshaw Burstein Represents Virginia-Based Owner of Property in Hip North Capitol Hill Neighborhood of Denver, Colorado01/24/2023

Warshaw Burstein represented a Virginia-based owner in the refinancing of the former Temple Emanuel building in the North Capitol Hill area of Denver. The team was led by Michael Zukerman, of counsel in the Warshaw Burstein Real Estate Group, and included counsel Chaya Shafran, and corporate partner Stephen Semian.

-

Client Alert: SEC Broadens Accredited Investor Definition Expanding Access to Capital Markets09/09/2020

On August 26, 2020, the Securities and Exchange Commission (SEC) adopted amendments to the “accredited investor” definition in Rule 501(a) of Regulation D under the Securities Act of 1933, as amended, that update and improve the accredited investor definition. The purpose of the amendments is to better identify investors that have sufficient knowledge and expertise to participate in investment opportunities that do not have the rigorous disclosure and procedural requirements and related investor protections, provided by registration under the Securities Act. The amendments are substantially as proposed by the SEC on December 18, 2019.

-

The Cares Act Amended: Paycheck Protection Program Flexibility Act of 20206/9/2020

If you have already received a PPP loan, the PPP Flexibility Act will not allow you to apply for or receive a second loan. With respect to loans applied for after enactment of the PPP Flexibility Act, although the covered period has been extended to 24 weeks, there has been no change to the maximum loan amount that can be borrowed under the PPP - it remains 2.5 times a borrower's one-month average payroll cost, as determined under the existing PPP application.

-

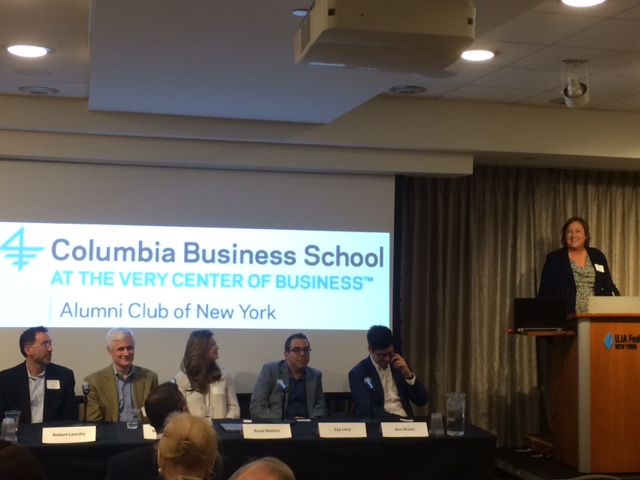

Warshaw Burstein sponsored a program for the Columbia Business School Alumni Association of New York about investing and working with fintech companies, "Alternative Lending: How This Fintech industry is Changing Access to Capital." Click here for a program summary.03/19/2018

Partners Lori Anne Czepiel, Marilyn Selby Okoshi and Steve Semian, and Counsel Kyle Taylor, attended the panel program, which featured senior executives from Warshaw clients and contacts such as ShopKeep, Kashable, Silicon Valley Bank, Zelkova Ventures and Barron's.

-

Partners Lori Anne Czepiel, Steve Semian and Thomas Filardo, along with Counsel Kyle Taylor, authored “Lending and Taking Security in the United States: Overview.”03/14/2018 | Practical Law

.jpg) Published by Thomson Reuters Practical Law Company as part of its Global Guide on Finance series, the article provides a high-level overview of the lending market, forms of security over assets, special purpose vehicles in secured lending, quasi-security, negative pledge, guarantees and loan agreements. It also covers creation and registration requirements for security interests; problem assets over which security is difficult to grant; risk areas for lenders; structuring the priority of debt; debt trading and transfer mechanisms; agent and trust concepts; enforcement of security interests and borrower insolvency; cross-border issues on loans; taxes; and proposals for reform.

Published by Thomson Reuters Practical Law Company as part of its Global Guide on Finance series, the article provides a high-level overview of the lending market, forms of security over assets, special purpose vehicles in secured lending, quasi-security, negative pledge, guarantees and loan agreements. It also covers creation and registration requirements for security interests; problem assets over which security is difficult to grant; risk areas for lenders; structuring the priority of debt; debt trading and transfer mechanisms; agent and trust concepts; enforcement of security interests and borrower insolvency; cross-border issues on loans; taxes; and proposals for reform.

The Thomson Reuters Practical Law Company Global Guide Series covers all business law areas across all major economies. Global Guides are written by leading lawyers and provide high level overviews of key regulatory laws in different jurisdictions with detailed practical overviews of legislation and developments.

To request a copy of “Lending and Taking Security in the United States: Overview” please click here.

V-Card

V-Card